Alpha Capital Rules

10% off first order: PROP10

Trading Strategy Rules and Prohibited Practices

Alpha Capital Group permits several common trading styles, but imposes strict boundaries on behavior it deems risky or exploitative.

Permitted:

- Hedging: Opening both long and short positions simultaneously is allowed.

- Stacking: Multiple entries in the same direction are permitted.

Prohibited:

You may not engage in the following:

- Arbitrage or latency exploitation, including tick scalping.

- Using trading signals from third parties or copying other users.

- Group trading or operating multiple accounts as a coordinated team.

- High-frequency trading bots or API trading.

- Executing trades via fund managers or external operators.

These violations are categorized as “hard breaches” and lead to immediate account cancellation and forfeiture of all profits.

Risk Parameters and Drawdown Rules

Every trading account with Alpha Capital Group includes firm limits on losses.

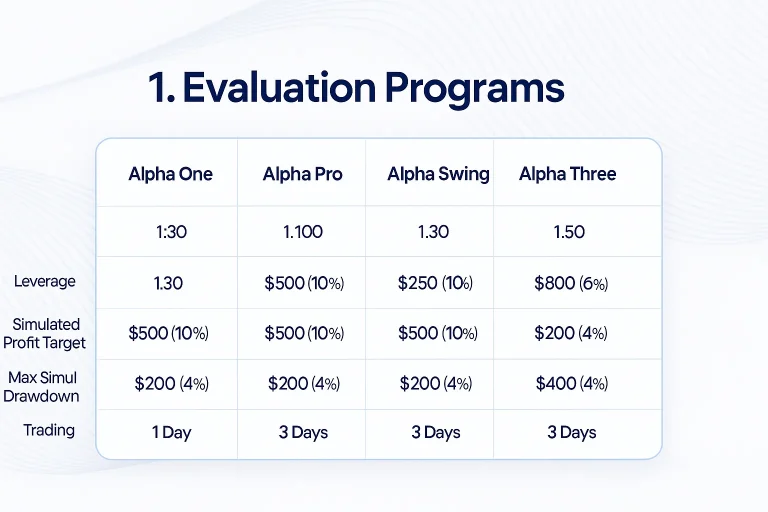

Account Type | Daily Drawdown Limit | Static Drawdown Limit |

Alpha Pro (8%, 10%) | 5% | 10% |

Alpha Three / One | 4% | 10% |

Alpha Swing | 5% | 10% |

Explanation:

- The daily limit is based on the balance at the start of the trading day.

- The total drawdown is static, not trailing—it’s calculated from your initial starting balance.

- Hitting or exceeding these values results in automatic termination of the account, regardless of your trade history.

Traders are advised to monitor their dashboard metrics daily, as the limits reset each day and do not offer buffer zones.

Trade Duration Restrictions

Short-term trades are allowed but tightly controlled. Alpha Capital does not support “flash” trading or strategies that rely on milliseconds of market inefficiencies.

Core rules:

- Your average trade duration must exceed 2 minutes across all trades.

- No more than 50% of your total profits can be made from trades shorter than 2 minutes.

If you break this rule—even with strong performance—the profits from all violating trades are excluded from payouts. On funded accounts, this may also trigger a reset or review.

News Event Restrictions

Alpha Capital Group limits trading activity during news events to reduce volatility abuse. Each plan has its own blackout timing window.

Account Type | Restricted Time Window | Notes |

Alpha Pro | ±2 minutes from news | No opening or closing trades |

Alpha Swing | ±2 minutes from news | Trades must remain open ≥2 minutes |

Alpha One / Three | ±5 minutes from news | Same restriction as Alpha Pro |

Evaluation Phase | No news restrictions | All times allowed |

Trades executed inside the blackout window lead to a soft breach. In that case, profits from the trade won’t count toward your total, but the account remains active.

Performance Fee Withdrawal Rules

Withdrawing profits isn’t just a matter of clicking “withdraw.” You must meet both performance and consistency requirements.

Required:

- At least 2% total net profit on the account.

- Your most profitable day must not account for more than 40% of total profits.

This is known as the “best day rule.” If you earned most of your profit in one trade or one day, Alpha Capital sees that as a risk concentration. Even if all rules are followed, this will block performance withdrawal.

Once you submit a withdrawal, the performance window resets, and new consistency rules begin for the next payout.

Lot Exposure and Leverage Limits

Leverage is available but capped based on asset class. Exceeding exposure leads to loss of earnings or termination.

Asset | Max Leverage |

FX | 1:30 |

Indices | 1:10 |

Metals | 1:9 |

Lot Limits by Account:

- For a $100k account (e.g., Alpha Swing), max open exposure is 20 lots.

- Traders must track their lot size to avoid violations, especially during rapid entries or multiple open trades.

These limits are static and do not scale during account growth unless through official scaling approval.

KYC and Identity Rules

Before receiving a funded account or withdrawing profit, you must pass Know Your Customer (KYC) verification.

Requirements:

- Valid government-issued ID.

- A real-time selfie (facial match).

- VPN and VPS use must be turned off during KYC.

If KYC fails or you cannot verify identity, the account will be cancelled and refunds may be denied.

Summary Table of Alpha Capital Group Rules

Category | Rule |

Strategy Restrictions | Hedging allowed, but no arbitrage or API automation |

Risk Limits | 5% daily, 10% total drawdown (4% daily for some plans) |

Trade Duration | >2 min average; <50% profit from <2-min trades |

News Window | No entry/exit ±2 to 5 mins of news event (depending on plan) |

Performance Fee Rules | ≥2% profit, ≤40% from best day |

Breach System | Soft = profit voided; Hard = account closure |

Lot Size / Leverage | Max FX 1:30; metals 1:9; lot limit per account size |

Identity Verification | ID and selfie required; no VPN during KYC |

Conclusion

The Alpha Capital Group Rules are precise and enforced without flexibility. Traders working with this firm must track not only their profits but also their timing, strategy type, and daily risk exposure. There is no margin for error in terms of compliance.

All violations are processed automatically and final. Whether you’re on a funded account or evaluation phase, these policies apply the same way. For anyone considering Alpha Capital Group, these rules should be understood in full before opening a position.

FAQ

Can I use signal services for trades?

No. All trading activity must originate from the account owner. Using signals or copying trades from others is a hard breach.

What if I accidentally open a trade during news?

This is a soft breach. Profits from that specific trade will be invalid, but the account remains active.

Can I scalp if I stretch the average duration?

Only if the average trade duration exceeds 2 minutes and less than 50% of profits come from trades under 2 minutes.

What if my VPN is on during KYC?

Your identity may fail to verify. Using VPNs or VPS during KYC can disqualify your account from funding.

Is there a grace period for drawdown rules?

No. If you exceed daily or static drawdown—even briefly—the system immediately terminates the account.