Alpha Capital Scaling Plan

10% off first order: PROP10

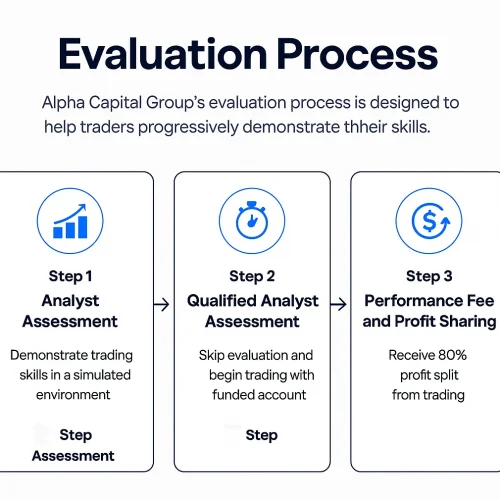

What is the Alpha Capital Group Scaling Plan

The Alpha Capital Group Scaling Plan is a conditional increase in your trading capital. It’s activated when you reach a specific profit level on your funded virtual account. That increase happens in stages: each time you earn a 10% profit (from the current funded balance), you become eligible for scaling.

The funding increases by 10% after each successful scale request. At the same time, traders withdraw up to 80% of the profit they made. However, the company doesn’t automatically issue new balances — you have to submit a formal request through their dashboard and confirm it via email. Also, it’s important to understand that this capital is still demo-based; Alpha Capital doesn’t claim the accounts are real-money backed.

Scaling can continue until you reach an upper cap of $2 million in total funded capital across all your scaled accounts. That’s the ceiling — not per account, but cumulatively.

Requirements and Eligibility

There are defined requirements. These aren’t optional — if you skip a step, the process halts.

You must:

- Generate at least 10% growth on your funded virtual account.

- Withdraw the entire profit via the dashboard before scaling begins.

- Return the balance to the original amount (before profit).

- Use the “Performance Fee” request and specify “Scaling Plan” as the reason.

- Send a manual email to Alpha Capital Group support confirming your intent.

After approval (within 24–48 business hours), your account is recreated with a new higher balance.

Scaling Conditions Across Plans

Different account types (Alpha Pro, Alpha Swing, Alpha Three) follow the same structure for scaling. The table below summarizes the starting conditions, profit targets, and scaling effects.| Account Type | Initial Balance | Profit to Trigger Scaling | Balance After Scaling | Lot Size Adjustment |

| Alpha Pro | $100,000 | +10% ($10,000) | $110,000 | No change at first scaling |

| Alpha Pro (2nd scale) | $110,000 | +10% ($11,000) | $121,000 | +10% increase in max lot size |

| Alpha Swing | Similar | +10% | +10% | Same as Alpha Pro |

| Alpha Three | Similar | +10% | +10% | Same as Alpha Pro |

Realistic Example

Let’s say you start with $100,000 on an Alpha Pro account.

- You trade successfully and reach $110,000. That’s your first 10%.

- You submit a performance-fee withdrawal. You take $8,000 (80%), and the account is reset to $110,000.

- On the next run, you grow the balance from $110,000 to $121,000.

- Again, you withdraw $8,800 (80% of profit) and move to $121,000.

- Now, your maximum allowed lot size increases by 10%.

This repeat process continues until the global ceiling of $2 million across all your accounts is hit.

Process Breakdown

Here is how the actual process happens, from start to end. This is not automated. Each step needs your involvement.

- You reach 10% profit on your active funded account.

- You initiate a full withdrawal of the profit through the performance-fee function.

- You submit a note in the request form with the reason: “Scaling Plan”.

- You send an email to the support address with your account details and request.

- Wait for 1–2 business days. Once approved, your account is recreated with a higher balance.

- The first 5 trading days of the new account do not count for performance-fee withdrawals.

Limits and Constraints

Scaling isn’t endless. Here’s what limits the process:

- Maximum capital: $2 million across all your active and historical scaled accounts.

- Scaling margin: Always 10% of current balance, not cumulative from the beginning.

- Manual processing: Each scale must be triggered by a request; it is not automated.

- Drawdown and trading rules: Each scaled account starts fresh, but rules stay the same.

These rules exist to prevent misuse and maintain structure. If you exceed drawdown, the scale attempt is void.

Key Differences Between Scaling vs Standard Trading

Feature | Standard Funded Account | After Scaling (2nd+) |

Max Capital | Up to $200k | Up to $2 million (total) |

Lot Size Flexibility | Fixed | Increases every second scale |

Profit Withdrawal Frequency | Anytime after 5 days | 5-day hold after each scale |

Automation | None | Still manual for every step |

Risk Limits | Fixed per plan | Reapplied at each scale |

Conclusion

The Alpha Capital Group Scaling Plan is not an automatic growth system. It requires active participation, exact timing, and full compliance with procedures. It offers a structured way to increase virtual capital in phases, but only if the trader repeatedly meets the company’s performance standards and follows the process precisely. There is no shortcut. You are not allowed to skip performance-fee withdrawals or request scaling without submitting email confirmation. Everything is documented and handled manually by the company.

Traders considering this path should weigh the effort involved against the gradual capital increase. It’s not immediate, but it does provide a trackable, rule-based method for account scaling — assuming all risk and performance thresholds are satisfied.

FAQ

Is the scaling automatic after I reach 10%?

No, you must manually request scaling via the dashboard and follow up with an email.

Can I accumulate multiple scaling profits and request at once?

No. You must withdraw profits first and reset balance before initiating the next scale.

Do lot sizes change with every scale?

No. Only starting from the second scaling onward, your lot size increases by 10%.

Can I lose scaling eligibility if I break a rule?

Yes. Breaching the daily or overall drawdown rules invalidates the current scale attempt.

Is the $2 million scaling cap per account or total?

The $2 million cap applies across all scaled accounts you have with Alpha Capital Group.