Alpha Capital Group Challenge

10% off first order: PROP10

What Is the Alpha Capital Group Challenge?

The challenge of Alpha Capital Group is designed to assess the trading abilities of individuals looking to secure a funded trading account. The challenge is structured to evaluate a trader’s consistency, risk management, and profitability under simulated conditions. Successful participants who meet the performance criteria are offered the opportunity to manage larger capital through a funded account.

Overview of the Evaluation Process

To complete the challenge, traders must follow a systematic evaluation process, which is broken down into multiple stages. These stages are designed to test various aspects of a trader’s skills, including risk management, profit generation, and overall consistency.

- Analyst Assessment: Traders begin by demonstrating their trading abilities through a simulated environment. This initial assessment is relatively low-cost and allows traders to show their skills without significant financial risk.

- Qualified Analyst: After completing the Analyst Assessment, traders who meet the required criteria may proceed to the Qualified Analyst stage, where they can fast-track their progress and start managing real capital within hours.

- Evaluation Completion: Once traders pass the evaluation stages and adhere to risk parameters, they are granted a funded trading account.

Key Features

The Alpha Capital Group challenge has several key features designed to offer flexibility, risk management, and growth opportunities for traders. Below, we will break down the essential components of the challenge:

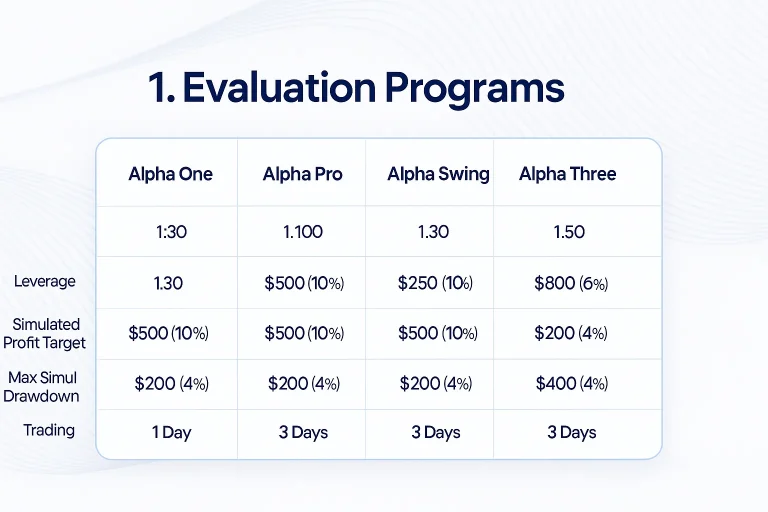

1. Evaluation Programs

Alpha Capital Group offers different evaluation programs to suit the needs of traders with varying skill levels and trading styles. These programs include:

Program | Leverage | Simulated Profit Target | Max Simulated Drawdown | Max Daily Drawdown | Trading Days |

Alpha One | 1:30 | $500 (10%) | $300 (6%) | $200 (4%) | 1 Day |

Alpha Pro | 1:100 | $500 (10%) | $500 (10%) | $200 (4%) | 3 Days |

Alpha Swing | 1:30 | $250 (5%) | $500 (10%) | $200 (4%) | 3 Days |

Alpha Three | 1:50 | $800 (8%) | $600 (6%) | $400 (4%) | 3 Days |

Each of these programs has different leverage options, profit targets, and drawdown limits, allowing traders to select the program that aligns with their risk tolerance and trading objectives.

2. Leverage and Risk Parameters

Leverage is a critical component in trading, allowing traders to control larger positions with smaller capital. The Alpha Capital Group offers varying leverage across its different programs:

- Alpha One: Leverage of 1:30

- Alpha Pro: Leverage up to 1:100

- Alpha Swing: Leverage up to 1:30

- Alpha Three: Leverage up to 1:50

In addition to leverage, traders must adhere to drawdown limits. Each program has a maximum simulated drawdown as well as a daily drawdown limit, ensuring that traders manage their risk effectively during the challenge.

3. Trading Days and Profit Targets

Each program has its own specific trading day requirements and profit targets:

- Alpha One: Traders must reach a 10% profit target within 1 day, with a maximum simulated drawdown of $300.

- Alpha Pro: Requires a 10% profit target over 3 days, with a 10% simulated drawdown.

- Alpha Swing: Similar to Alpha One, but with a lower profit target of 5% over 3 days.

- Alpha Three: Traders must reach an 8% profit target, with a more flexible drawdown and trading day requirements.

These structured targets ensure that traders are not only profitable but also demonstrate consistency in their performance.

4. Profit Split and Payouts

Upon successful completion of the Alpha Capital Group challenge, traders are rewarded with an 80% profit split, allowing them to keep the majority of their earnings. This incentivizes traders to maintain consistency and risk management while scaling their trading activity. Payouts are processed based on the terms of the individual program and are contingent on meeting the required performance benchmarks.

Risk Management

Risk management is a fundamental component of the challenge. The challenge ensures that traders demonstrate the ability to manage risk by enforcing strict daily and overall drawdown limits. These limits prevent traders from taking excessive risks that could jeopardize their capital.

Daily and Overall Drawdown Limits

Each program has specific limits on the maximum allowable loss:

- Daily Drawdown: Each program has a daily drawdown limit (e.g., 4% in the Alpha One program). If this limit is exceeded, the trader fails the evaluation.

- Overall Drawdown: The overall drawdown limit ensures that traders cannot lose more than a certain percentage of their account balance during the evaluation process.

These risk parameters help maintain the integrity of the challenge, ensuring that only traders with sound risk management strategies succeed.

Conclusion

The Alpha Capital Group offers traders a unique opportunity to demonstrate their trading skills and manage larger amounts of capital once they complete the evaluation process. With multiple programs tailored to different levels of experience and trading styles, traders can select the program that best aligns with their goals. By adhering to the challenge’s risk management principles and profit targets, successful participants are rewarded with the chance to manage real capital and earn a profit share.

For traders looking to take their trading career to the next level, the Alpha Capital Group provides an excellent opportunity to prove their abilities and manage substantial capital.

FAQ

What is the Alpha Capital Group challenge?

The Alpha Capital Group challenge is a proprietary trading evaluation that tests traders’ skills, risk management, and consistency to qualify for a funded trading account.

How do I participate in the challenges?

To participate, select one of the evaluation programs on the Alpha Capital Group website, complete the registration, and begin the challenge.

What happens if I exceed the drawdown limits?

If you exceed the daily or overall drawdown limits, you will fail the evaluation and must start again.

How is the profit split structured?

Traders who successfully complete the challenge are awarded an 80% profit split on the capital they manage.

What are the profit targets for each evaluation program?

Profit targets vary depending on the program, ranging from 5% to 10% of the simulated capital.