Alpha Capital Group Leverage

10% off first order: PROP10

What is Leverage?

Leverage in trading refers to the ability to control a larger position than what is available in a trader’s account balance. This is achieved by borrowing capital from the broker, allowing traders to amplify both their profits and losses. For instance, if a trader uses leverage of 1:100, they can control $100 in market exposure for every $1 of their own capital.

Leverage can be a powerful tool, but it must be used carefully. If a trade goes against a trader’s position, the losses are also magnified. This makes effective risk management strategies essential when using leverage in any trading environment, including at Alpha Capital Group.

Alpha Capital Group Leverage Options

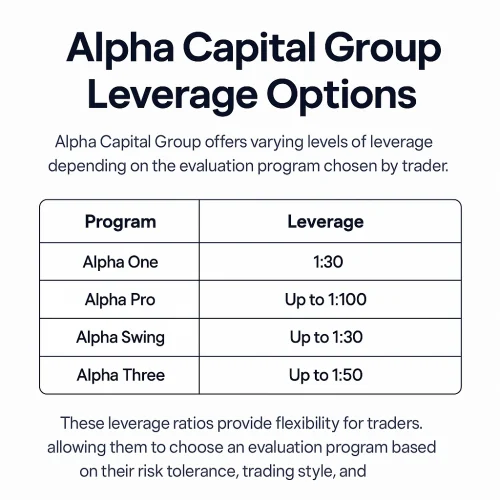

Alpha Capital Group offers varying levels of leverage depending on the evaluation program chosen by the trader. Each program is tailored to different trading strategies and experience levels, providing traders with the flexibility to select the best fit for their risk profile and objectives.

Here’s an overview of the leverage options available within the Alpha Capital Group leverage framework:

Program | Leverage |

Alpha One | 1:30 |

Alpha Pro | Up to 1:100 |

Alpha Swing | Up to 1:30 |

Alpha Three | Up to 1:50 |

These leverage ratios provide flexibility for traders, allowing them to choose an evaluation program based on their risk tolerance, trading style, and financial goals.

Alpha One: Leverage of 1:30

The Alpha One program provides a leverage ratio of 1:30. This relatively lower leverage allows traders to manage their positions with a more cautious approach. It’s particularly useful for those who are new to trading or prefer to limit their risk exposure. With 1:30 leverage, traders can control a larger position than their initial capital would allow, but they are not exposed to the extreme volatility that comes with higher leverage.

Alpha Pro: Leverage up to 1:100

The Alpha Pro program offers a significantly higher leverage, up to 1:100. This is ideal for more experienced traders who are comfortable with higher risks and wish to amplify their positions for greater profit potential. With leverage of up to 1:100, traders can take much larger positions, but they also need to implement strict risk management practices to avoid excessive losses.

Alpha Swing: Leverage up to 1:30

The Alpha Swing program also offers leverage up to 1:30, similar to the Alpha One program. This leverage level provides a balanced approach, allowing traders to take on reasonable positions while still maintaining a conservative risk profile. This program is suitable for traders who prefer a moderate level of leverage and want to avoid the heightened risk that comes with more aggressive trading strategies.

Alpha Three: Leverage up to 1:50

The Alpha Three program offers a middle ground with leverage up to 1:50. This is ideal for traders who want more flexibility than what’s provided by 1:30 leverage but are not willing to take on the higher risk of 1:100 leverage. The 1:50 ratio offers a good balance for traders seeking to scale up their trades while still keeping risks at a manageable level.

How Leverage Affects Trading

Leverage is a crucial aspect of trading that can either enhance your profits or increase your losses. Understanding how to use leverage appropriately is essential for any trader, especially when working with programs like those offered by Alpha Capital Group leverage. Let’s break down how leverage affects your trading strategy:

Potential Gains

Leverage amplifies both potential profits and losses. For example, in the Alpha Pro program, with 1:100 leverage, you could potentially make larger profits with a smaller investment. If you are able to predict market movements accurately, the profits from a trade could be significant.

Potential Losses

However, the risk of using leverage is that losses are also amplified. If a trade moves against you, the amount of capital lost could quickly exceed your initial investment. This makes it critical to set stop-loss orders and use proper risk management techniques, especially when trading with higher leverage ratios like 1:100 in Alpha Pro.

Risk Management

Effective risk management is essential when using leverage. Traders should:

- Set stop-loss orders to automatically close trades at a predetermined loss point.

- Use position sizing to ensure that no single trade exposes too much capital.

- Avoid using excessive leverage on high-risk trades.

Without proper risk management, traders can face significant losses, especially when using higher leverage ratios.

Pros and Cons of Using Leverage with Alpha Capital Group

Pros

- Increased Trading Opportunities: Leverage allows traders to open larger positions, increasing the potential to make more substantial profits with smaller amounts of capital.

- Flexibility in Trading: With various leverage options across different programs, traders can choose a program that matches their risk tolerance and trading strategy.

- Scalable Profits: Traders can scale their profits by using leverage strategically to increase their market exposure.

Cons

- Amplified Losses: Leverage magnifies both gains and losses, and without careful risk management, traders may suffer larger losses than expected.

- Emotional Pressure: The use of high leverage can create emotional stress, as traders may feel pressured to monitor their trades closely.

- Increased Risk: The more leverage used, the higher the potential for large losses if the market moves against the trader’s position.

In conclusion, Alpha Capital Group leverage offers traders the flexibility to control larger positions with smaller amounts of capital. With programs ranging from 1:30 to 1:100 leverage, traders can choose the level of risk that aligns with their experience and trading style. However, it’s important to approach leverage carefully, as it can amplify both profits and losses. Traders are encouraged to use risk management techniques, such as stop-loss orders and position sizing, to protect their capital when utilizing leverage in their trades.

Ultimately, Alpha Capital Group provides a valuable tool for experienced traders, but it must be used responsibly to ensure that the benefits outweigh the risks.

FAQ

What is leverage in trading?

Leverage allows traders to control larger positions than their initial capital would allow, amplifying both potential profits and losses.

How much leverage can I use with Alpha Capital Group?

Alpha Capital Group offers leverage ranging from 1:30 to 1:100, depending on the program you choose.

Is higher leverage better for profits?

While higher leverage can increase potential profits, it also increases the risk of larger losses. It’s essential to use leverage based on your risk tolerance and trading strategy.

How can I manage risk when using leverage?

Traders can manage risk by setting stop-loss orders, adjusting position sizes, and using leverage conservatively.

Can I adjust my leverage after starting a program?

Leverage is typically set at the start of the program, so any adjustments would need to be discussed directly with Alpha Capital Group.