Alpha Capital Group Reviews

10% off first order: PROP10

Company Overview: What Is Alpha Capital Group?

Alpha Capital Group is a proprietary trading firm that provides traders with the opportunity to manage capital through a structured evaluation process. The firm was established in 2021 and offers an innovative model for traders who wish to access substantial capital without risking their own funds.

Here’s a breakdown of the core aspects of the company:

- Company Name: Alpha Capital Group

- Founded: November 2021

- Headquarters: London, United Kingdom

- Website: Alpha Capital Group

- Funding Programs: Offers funding based on a two-phase evaluation process

Traders can access accounts ranging from $10,000 to $200,000, and the firm promises an 80% profit split upon successful completion of the evaluation. The evaluation consists of two phases: achieving an 8% profit target in Phase 1 and a 5% profit target in Phase 2.

The firm has received both praise and criticism, making it important to analyze Alpha Capital Group reviews from multiple perspectives.

Alpha Capital Group Evaluation Process

Alpha Capital Group offers a range of evaluations tailored to traders at different stages of their journey. These programs are designed to assess various skills, such as market analysis, risk management, and consistency, and allow traders to progress through different stages based on their performance.

Three Main Evaluation Programs Offered by Alpha Capital Group:

- Alpha One

- Alpha Pro

- Alpha Swing

- Alpha Three

These evaluation programs allow traders to select an assessment plan based on their experience level. Each program has different requirements, performance targets, and risk parameters, ensuring that there is an option suitable for traders at every stage.

Evaluation Structure

| Program | Leverage | Simulated Profit Target | Simulated Drawdown | Max Daily Drawdown | Trading Days Requirement | Assessment Price |

| Alpha One | 1:30 | $500 (10%) | $300 (6%) | $200 (4%) | 1 Day | $50 |

| Alpha Pro | 1:100 | $500 (10%) | $500 (10%) | $200 (4%) | 3 Days | $50 |

| Alpha Swing | 1:30 | $250 (5%) | $500 (10%) | $200 (4%) | 3 Days | $70 |

| Alpha Three | 1:50 | $800 (8%) | $600 (6%) | $400 (4%) | 3 Days | $67 |

As shown in the table above, each program has different leverage options, profit targets, and drawdown limits. Traders are required to meet these targets and risk parameters to qualify for a funded account. Once the evaluation process is completed successfully, traders can start earning profits within hours of opening their account, based on the terms of the program.

Evaluation Process

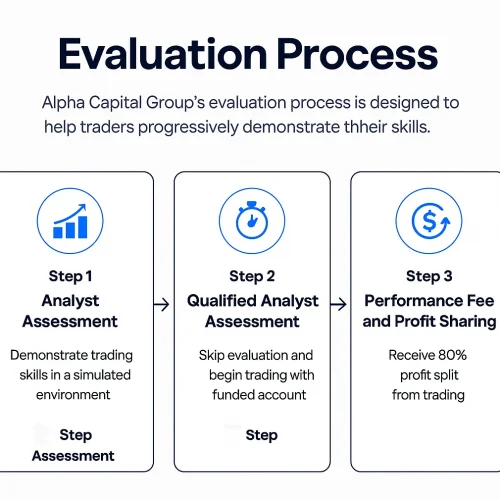

Alpha Capital Group’s evaluation process is designed to help traders progressively demonstrate their skills. The process involves the following steps:

Step 1: Analyst Assessment

Traders begin with the Analyst Assessment, where they must demonstrate their trading skills under a simulated trading environment. This stage is priced at an affordable rate and helps traders test their abilities with minimal investment.

Step 2: Qualified Analyst Assessment

For those who want to fast-track their progress, Alpha Capital Group offers the Qualified Analyst Assessment. This step allows traders to skip the evaluation process entirely and begin trading with a funded account within hours of completing the assessment. However, to qualify for this option, traders must meet specific performance criteria.

Step 3: Performance Fee and Profit Sharing

After passing the evaluation stages, traders who qualify for a funded account will be rewarded with an 80% profit split. This incentivizes traders to maintain consistency and good risk management throughout their trading activities.

Key Features of Alpha Capital Group

In addition to the evaluation process, Alpha Capital Group offers several features to its users. Below are the key aspects to consider when looking at Alpha Capital Group reviews.

Account Sizes

Alpha Capital Group offers a range of account sizes, which allow traders to choose the best fit for their risk tolerance and trading strategies. The account sizes range from $10,000 to $200,000.

Profit Split

Alpha Capital Group offers a highly attractive profit split of 80%. This means that once a trader successfully passes the evaluation and is granted a funded account, they will keep 80% of the profits generated from their trades.

Risk Management

The firm has strict risk management rules in place to ensure that traders do not exceed certain loss limits. These rules include:

- A maximum daily loss of 5%

- A maximum overall loss of 10%

These parameters help protect the firm from significant losses while ensuring that traders adhere to disciplined risk management practices.

Trading Platforms

Alpha Capital Group uses MetaTrader 5 (MT5) as its primary trading platform. MT5 is a well-known platform that is popular among traders due to its comprehensive features and ease of use.

User Reviews: What Do Traders Say?

Myfxbook Reviews

On Myfxbook, Alpha Capital Group has generally received positive feedback. Traders have rated the platform highly across various categories:

- Platform: 5/5

- Pricing: 5/5

- Customer Service: 5/5

- Features: 5/5

Traders have praised the firm’s platform and customer service, with many highlighting how smooth the evaluation process is. One common sentiment shared is the ease of use and the efficiency of the entire process.

Forex Brokers Reviews

Forex Brokers Reviews provides a comprehensive look at Alpha Capital Group’s offerings, with emphasis on the firm’s evaluation program and customer service. Some of the notable points include:

Feature | Details |

Account Sizes | From $10,000 to $200,000 |

Profit Split | 80% |

Profit Targets | 8% for Phase 1, 5% for Phase 2 |

Risk Management | 5% daily loss, 10% overall loss |

Trading Platforms | MT5 |

Customer Support | Excellent response times and helpful guidance |

This review highlights Alpha Capital Group’s commitment to providing traders with a wide array of resources to succeed, but it also raises concerns about some of the regulatory issues that have been noted in other reviews.

Dumb Little Man Review

Dumb Little Man provides an in-depth overview of Alpha Capital Group’s services, mentioning that the firm’s evaluation fees can range from $97 to $997, depending on the chosen account size. They also highlight the free monthly trading competitions that Alpha Capital Group organizes and mention a discount code (ACGWIN) for new users.

However, some concerns have been raised about the non-refundable nature of the evaluation fees, which could be seen as a drawback for traders who may not pass the evaluation.

Pros and Cons of Alpha Capital Group

Pros

- High Profit Split: Traders keep 80% of the profits.

- Diverse Account Sizes: Accounts range from $10,000 to $200,000, catering to different types of traders.

- Educational Resources: Access to tutorials, articles, and webinars that can help traders improve their skills.

- Free Monthly Trading Competitions: Alpha Capital Group runs competitions that give traders a chance to test their skills and win prizes.

Cons

- Regulatory Concerns: The firm has faced some regulatory scrutiny, with warnings issued by bodies like CONSOB, FCA, and IOSCO.

- Non-Refundable Fees: Evaluation fees are non-refundable, which may deter some traders.

- Inactive Domain: Some users have reported that the domain alphacapitalgroup.uk is currently inactive.

Conclusion

In conclusion, Alpha Capital Group reviews reveal that the firm offers a competitive and structured trading environment with a robust evaluation process. The attractive 80% profit split and varied account sizes are key selling points for many traders. However, potential users should be aware of the regulatory issues and non-refundable evaluation fees. It’s essential to carefully evaluate these aspects before committing to the firm’s services.

FAQ

What is the profit split offered by Alpha Capital Group?

Alpha Capital Group offers an 80% profit split to traders once they pass the evaluation process.

How long does the evaluation process take?

The evaluation process consists of two phases, with traders given the opportunity to complete both phases at their own pace. Typically, it can take a few weeks to a couple of months, depending on how quickly traders meet the profit targets.

What platforms are available for trading with Alpha Capital Group?

Alpha Capital Group uses the MetaTrader 5 (MT5) trading platform for its evaluations and funded accounts.

Are there any risks associated with Alpha Capital Group?

Yes, while the firm offers excellent profit-sharing terms, there are regulatory concerns that should be considered. Additionally, evaluation fees are non-refundable, which could be a risk if you do not pass the evaluation.

What happens if I exceed the loss limits during the evaluation?

If you exceed the 5% daily loss or 10% overall loss limits during the evaluation, your account will be disqualified, and you will need to start the process again.